April 2014-SpringClean Your QuickBooks Company File

There are a lot of clues that indicate trouble with your QuickBooks company file. Is it time for a check-up and tune-up?

After this ridiculously long winter, you’ll probably hear few complaints about things like puddles in the street, summer heat and spring cleaning. Most people are eager to throw open the doors and windows, and attack the dirt that the season left behind, both inside and outside of the house.

It’s not hard to see when your home is dirty. QuickBooks company file errors are harder to detect, but they’re there, including:

- Performance problems

- Inability to execute specific processes, like upgrading

- Occasional program crashes

- Missing data (accounts, names, etc.)

- Refusal to complete transactions, and

- Mistakes in reports.

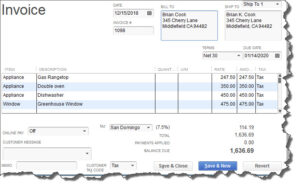

Figure 1: If some transactions won’t go through when you click one of the Save buttons – or worse, QuickBooks shuts down — you may have a corrupted company file.

Call for Help

The best thing you can do if you notice problems like this cropping up in QuickBooks – especially if you’re experiencing multiple ones – is to contact us. We understand the file structure of QuickBooks company data, and we have access to tools that you don’t. We can analyze your file and take steps to correct the problem(s).

One of the reasons QuickBooks files get corrupt is simply because they grow too big. That’s either a sign of your company’s success or of a lack of periodic maintenance that you can do yourself. QuickBooks contains some built-in tools that you can run occasionally to minimize your file size.

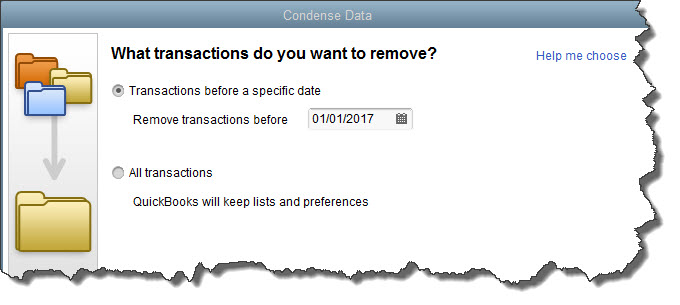

One thing you can do on your own is to rid QuickBooks of old, unneeded data. The software contains a Condense Data utility that can do this automatically. But just because QuickBooks offers a tool doesn’t mean that you should use it on your own.

Figure 2: Yes, QuickBooks allows you to use this tool on your own. But if you really want to preserve the integrity of your data, let us help.

A Risky Utility

The program’s documentation for this utility contains a list of warnings and preparation steps a mile long.

We recommend that you don’t use this tool. Same goes for Verify Data and Rebuild Data in the Utilities menu. If you lose a significant amount of company data, you can also lose your company. It’s happened to numerous businesses.

Be Proactive

Instead, start practicing good preventive medicine to keep your QuickBooks company file healthy. Once a month or so, perhaps at the same time you reconcile your bank accounts, do a manual check of your major Lists.

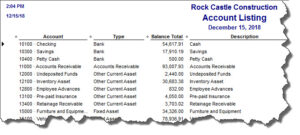

Run the Account Listing report (Lists | Chart of Accounts | Reports | Account Listing). Are all of your bank accounts still active? Do you see accounts that you no longer used or which duplicate each other? Don’t try to “fix” the Chart of Accounts on your own. Let us help.

Figure 3: You might run this report periodically to see if it can be abbreviated.

Be very careful here, but if there are Customers and Vendors that have been off your radar for a long time, consider removing them – once you’re sure your interaction with them is history. Same goes for Items and Jobs. Go through the other lists in this menu with a critical but conservative eye. If there’s any doubt, leave them there.

A Few Alternatives

There are other options. Your copy of QuickBooks may be misbehaving because it’s unable to handle the depth and complexity of your company. It may be time to upgrade. If you’re using QuickBooks Pro, move up to Premier. And if Premier isn’t cutting it anymore, consider QuickBooks Enterprise Solutions.

There’s cost involved, of course, but you may already be losing money by losing time because of your version’s limitations. All editions of QuickBooks look and work similarly, so your learning curve will be minimal.

Also, try to minimize the number of open windows that are active in QuickBooks. That will improve your performance. And what about your hardware? Is it getting a little long in the tooth? At least consider adding memory, but PCs are cheap these days. If you’re having problems with many of your applications, it may be time for an upgrade.

A Stitch in Time…

We’ve suggested many times here that you contact us for help with your spring cleanup. While that may seem self-serving, remember that it takes us a lot less time and money to take preventive steps with your QuickBooks company file than to troubleshoot a broken one.

March 2014-5 Ways to Accelerate Your Receivables in QuickBooks

Increasing your income is good. But even if you can’t, you can still take steps to collect the money you’re already owed faster. Here are five.

If you asked five small business owners to name the top three roadblocks they face in their quest for ongoing profitability, it’s likely that all five would point to slow payments.

It’s everyone’s problem. Accounts receivable requires constant monitoring. As satisfying as it can be to dispatch a group of invoices, you know that it’s going to take some work to bring in payment for at least some of them.

By using QuickBooks’ tools and complying with accounting best practices, you’ll be more confident during the invoicing stage that what you’re owed will actually be in your bank account in a reasonable amount of time. Here are five things that we suggest.

Let customers pay invoices electronically

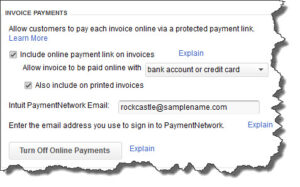

Figure 1: You’re likely to get paid faster if you let customers pay electronically when they receive an invoice. Go to Edit | Preferences | Payments | Company Preferences.

A few years ago, this was a good idea. In 2014, when people have stopped carrying checkbooks and are accustomed to using their mobile devices to pay for merchandise, it’s become almost required. Whether or not you know it, you’re probably losing some business if you don’t have a merchant account that supports credit and debit card payments, and possibly e-checks.

If you have an online storefront, you’ve undoubtedly been accepting plastic for a long time now. Not many shoppers want to place an order on a website and hunt for envelopes and stamps and blank checks to complete it. If you invoice customers, it’s just as critical that you allow them to remit payment ASAP.

Not set up with a merchant account yet? We can help you get started with the Intuit Payment Network.

Keep a close watch on your A/R reports

Part of being proactive with your accounts receivable is being vigilant and informed. Create and customize A/R reports regularly. When you customize your A/R Aging Detail report, for example, in addition to the other columns that you include, be sure that Terms, Due Date, Bill Date, Aging and Open Balance are turned on (click Customize Report | Display and click in front of each column label).

You should also be looking at Open Invoices and Collections Report frequently, or assigning someone else to monitor them closely. We can help here by creating more complex financial reports periodically, like Statement of Cash Flows.

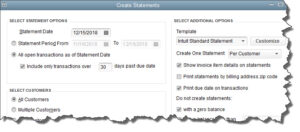

Send statements

Figure 2: In this window, QuickBooks wants you to create filters to identify customers who should receive statements. Here, everyone with transactions that are more than 30 days old will be included.

Invoices are generally the preferred way to bill your customers, but you should consider sending statements in addition when customers have outstanding balances past a certain date. QuickBooks sometimes calls these reminder statements. You’re not providing the recipients with any new information; you’re simply sending a kind of report that lists all invoices sent, credit memos and payment received.

To generate statements, click Customers | Create Statements. You’ll see the window pictured above. You can send statements to everyone, a defined group or one customer, and you can define the past-due status that you want to target in addition to other options.

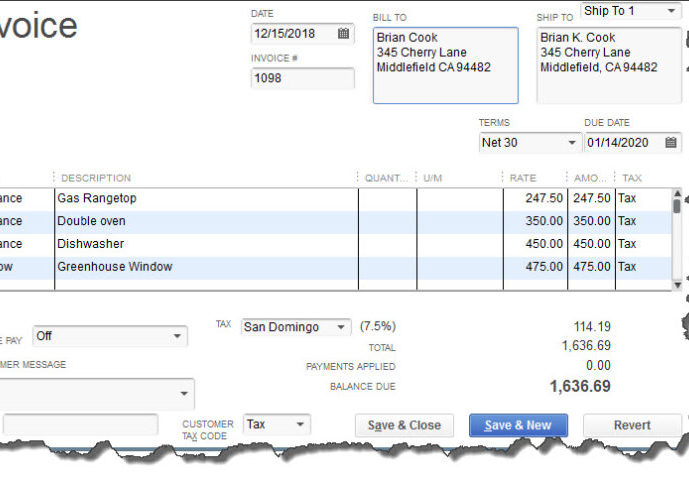

Send accurate invoices the first time

Few things will slow down your accounts receivable more than incorrect invoices. The customer can wait until payment is almost due to dispute the charges, which means that they’ll probably get another 15 or 30 days (or whatever their terms are) to pay the amended bill.

So whoever is responsible for creating invoices needs to be checking and re-checking them. If it’s logistically possible depending on your workflow, have them verified by a second employee.

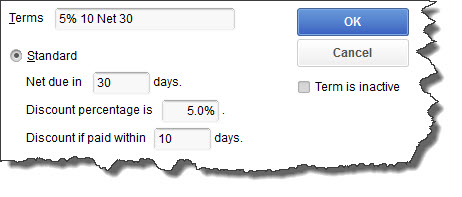

Offer discounts for early payment and assess finance charges.

Offering discounts is a balancing act. You’ll be getting less money for your sale – even 5 percent multiplied by many customers can add up – but it may make sense financially for you to take a small hit in return for being able to deposit the payment sooner. We can help you do the math here.

To offer this, you’ll have to set up your discount scenario as a Term option (Lists | Customer & Vendor Profile Lists | Terms List), as seen here:

Figure 3: This Standard discount term gives customers a 5 percent discount if their invoice is paid within 10 days.

To make a customer eligible for the discount, open the Customer Center and double-click on a customer, then on Payment Settings| Payment Terms.

You might also want to be assessing finance charges. The revenue you bring in from finance charges will probably be negligible. But sometimes, just knowing that a late payment will be more costly may prompt your customers to settle up in a timely fashion.

Whatever approaches you choose to accelerate your receivables, be consistent. If any of your customers should compare notes, you want to be regarded as being firm but fair.