December 2012 – Say Good-Bye to 2012 and Ready QuickBooks for 2013

When you turn the calendar page and make a new start on January 1, your accounting software could use some closure on the year that’s passed. Here are some actions you can take to ring out the old and ring in the new. There’s more you can do (we can help you with the advanced activities) but we’ll just hit the highlights here.

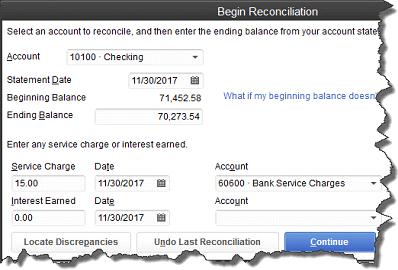

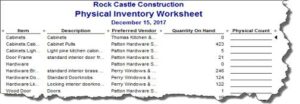

• Reconcile, reconcile, reconcile. We know reconciling may not be one of your favorite chores, but reconciling your bank and credit accounts every month is very important. If you haven’t made the time to do it on a monthly basis, then now is the time to bring it up to date for all of 2012. Enter missing transactions and review your outstanding check list.

Figure 1: You can make yourself crazy looking for a nickel when you’re reconciling, but it’s a critical function.

• Make accrual adjustments. This is complicated, and it only applies if you accrue payroll and liabilities or prepay expenses that are then carried as assets. Not to worry — we can create journal entries for you.

• Close your books. I strongly encourage all my clients to set a password to close out 2012. This will stop people from inadvertently entering 2013 data with a 2012 date. QuickBooks is one of the few accounting programs that does not require you to close your books. The program makes some automatic adjustments at the end of the fiscal year to prepare your books for the new year. However, you have to close the year out yourself.

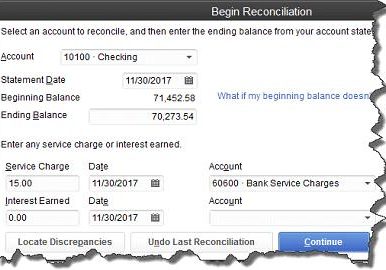

• Do a physical inventory. Then compare this with what QuickBooks says.

Reports | Inventory | Physical Inventory Worksheet.

• Check W-2 and 1099 data. You can’t create these forms, of course, until after your final 2012 payroll, but you can get a head start. Ask employees to verify their names, addresses and Social Security numbers for accuracy. Also, make sure that your EIN and SEIN are correct, as well as the company address. Do you have W-9s for all your independent contractors?

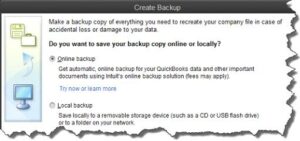

• Clean up, back up. You can monitor the health of your QuickBooks data file any time. But year-end is a good time to scrutinize your software’s performance. Has it slowed down, started crashing or returning error messages? We can troubleshoot to find the problem and clean it up. We’re sure you’ve been backing up your file faithfully, but archive all of 2012 and store it in a very safe offsite location – or use Intuit Data Protect for online storage. To back-up a data file, select the File menu, choose Save Copy or Back-up, then Backup Copy and follow prompts for saving the back-up file. You should be verifying the data to ensure that there are no errors in the QuickBooks database. To run this process, go to the File menu, choose Utilities, then Verify Data. If there are any database errors found, please contact us.

• Double-check tax liabilities. If you’re handling your own payroll, look back to see whether all of your payments and filings have been completed. Double check your balance sheet. The payroll liabilities balance should be zero.

The above are just some basic year- end items to get you started. We look forward to meeting with you to discuss your 2012 financials and your strategies for maximizing your profits in 2013.

Have a great December!